Manufacturing has been one of the foundations and main drivers for the expansion of China’s economy, placing it as one of the world’s leading economies today.

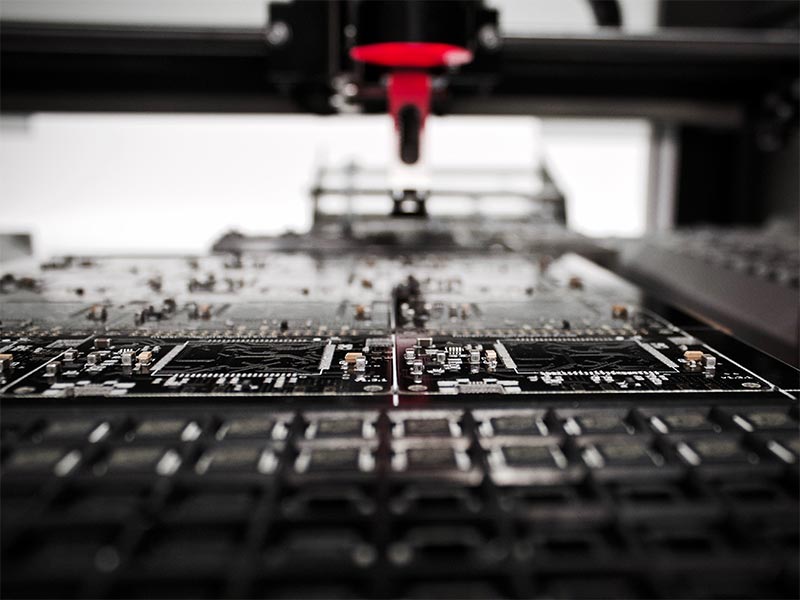

This impressive evolution was possible based on its large workforce, low wages and government support and initiatives in manufacturing, but time is running out. As other world industrial leaders continue to develop technologically and the Chinese society continues to prosper, it is not possible for China to remain centered around a strategy of labor intensive, low cost production strategy. Recognizing the opportunities and challenges that this brings to the continued development of the country, government has launched the “Made in China 2025” (MIC 2025) policy to drive automation and intelligent manufacturing as a stepping stone to remain relevant and competitive in the future world economy. The unveiling of MIC 2025 shows a clear blueprint of the administration’s approach to transform China into an advanced manufacturing leader. Together with the 13th Five-year plan, MIC 2025 formalizes a broader strategy to use state resources to alter and create comparative advantages on a global scale. Various innovations such as 3D printing, cloud computing and big data are key developments needed in order to transform China into a world-class industrial leader with innovation capacity and economic efficiency. In the race to fill these gaps, considerable opportunities for projects and partnerships will be created to drive the necessary upgrade and transformation.

The approach of MIC 2025, similar to the idea of German plan “Industrie 4.0”, draws plans to digitization of industries with support programs like Internet of Things (IoT), robots, intelligent manufacturing systems and cloud computing. Compared to the German industry, Chinese manufacturing is more labor intensive with limited automatization and hardly utilizing digitized software like Enterprise Resource Planning (ERP) or Product Lifecycle Management (PLM) so the journey to achieve “Industrie 4.0” will be longer for the Chinese. With MIC 2025, China aims to catch-up technologically to be on equal footing with Germany, USA, and Japan by 2045. Large companies like ABB, Cisco, IBM and General Electric recognize the potential opportunities and are prepared and willing to supply China with the required technology to accelerate its industrial upgrading.

Within the sectors highlighted by MIC 2025, many domestic Chinese firms still have to overcome significant technological gaps when compared to foreign companies with extended timelines and continued financial support to be essential to take them into the next stage. To jumpstart the technological catch-up with the advanced countries, China has encouraged mergers and acquisitions (M&A) in targeted sectors. State funds are being injected into private equity to support foreign acquisitions. In 2016, M&A in the industrials sector represented 51% of all outbound M&A, up from an average of 26% from 2005-2010. Moreover, on Jan 17, 2017, the state council issued a plan named “Circular Concerning Measures on Further Opening up and Actively Utilizing Foreign Investment”, which lays out new measures to further open up the economy, improve business environment, and boost foreign investment. These programs mark only the beginning and foreign companies that engage in participation during the early stages of MIC 2025 will play significant roles to set international standards and enjoy improved market access.

Furthermore, the Belt and Road Initiative (BRI) presented in 2013 aiming to build a modern-day “silk road” connecting China by land to Southeast Asia, Middle East, Europe, and beyond to Africa opens the world markets for Chinese products. Its focus on international cooperation will promote increased efforts by Chinese companies to ‘go out’ and create unique opportunities in the resources industry and cross-border services sector. The landlocked “Belt” connects two of the world’s largest economies, China and Europe, and will emerge as a major logistics corridor to create significant opportunities in various areas such as manufacturing, technology, warehousing, real estate, etc. The expansiveness of BRI’s massive scale, spanning 65 countries across 3 continents, reveals China’s capacity for overseas investment and projects the new Chinese soft power onto the world stage. In summary, the MIC 2025 plan along with the BRI project offer true opportunities, both short and medium term, for foreign investors to collaborate with China working on the key areas to achieve the ambitious target to become a world advanced industrial leader in the new intelligent manufacturing era.

References:

- China Monitor: Will German Technology Help China Catch Up with the West?

- U.S. Chamber of Commerce: Made in China 2025

- KPMG: The 13th Five-Year Plan – China’s transformation and integration with the world economy

- Baker McKenzie: Belt & Road: Opportunity & Risk

Read about our market entry and expansion consulting services and our experience in the industrial goods & services sector.

The insights provided in this article are for general informational purposes only and do not constitute financial advice. We do not warrant the reliability, suitability, or correctness of the content. Readers are advised to conduct independent research and consult with a qualified financial advisor before making any investment decisions. Investing in financial markets carries risks, including the risk of loss of principal. Past performance does not guarantee future results.

The views expressed herein are those of the author(s) and do not necessarily reflect the company's official policy. We disclaim any liability for any loss or damage arising from the use of or reliance on this article or its content. ARC Group relies on reliable sources, data, and individuals for its analysis, but accuracy cannot be guaranteed. Forward-looking information is based on subjective judgments about the future and should be used cautiously. We cannot guarantee the fulfillment of forecasts and forward-looking estimates. Any investment decisions based on our information should be independently made by the investor.

Readers are encouraged to assess their financial situation, risk tolerance, and investment objectives before making any financial decisions, seeking professional advice as needed.