Market overview

There are two main methods of cross-border e-commerce: the bonded import method and the direct purchase import method. The bonded import method is further broken down into the bonded warehouse model (B2B2C) and the direct mail (B2C) model. The import tariff for B2B2C and B2C is temporarily set at 0 percent and VAT is at 11.9 percent.

In 2018, China will generate the most revenue in alcoholic beverages globally, with an expected US$285.9 million domestically. The alcoholic beverage market in China is split into four segments, namely beer, spirits, wine, and others (including cider/berry and rice wine). Beer is the largest alcoholic beverage category in China, accounting for 71% of the total alcohol volume.

Chinese drinking habits are changing. Consumers have acquired a taste for premium and innovation products. In addition, premium, high quality alcoholic products are necessary for Chinese business dinners and formal social occasions. With the rise of China’s middle class and the increase in their discretionary income, many customers can now afford foreign-made and foreign-branded alcoholic beverages. The data shows that craft beer, a quickly growing market segment, has growth 25% in the last couple of years. The demand for spirits is expected to increase 1.8% in 2018. This article aims to analyze how craft beer and spirits attract consumers and the retail, channels available to the imported alcoholic beverage market.

Craft Beer and Spirits

The newest interest of the majority of beer lovers in China lies with imported craft beer, again in pursuit of premium taste. As a high-end product in the beer category, craft beer attracts many young people, especially in the 20 to 35 year-old age range, who who are distinguished by their love for material possessions. In the craft market, the unit price can vary from 20 to 30 RMB. The demand for craft beer in 2017 has increased 25 percent. This small segment of the total beer market in China has captured a large profit as a result of the growing demand. An investigation from Hatchery, Beijing’s first culinary incubator, shows that international beer giants have taken the opportunity to come into the China market and buy out successful breweries, then promoting their own brands, creating higher price points, and taking large chunks of market share.

Meanwhile, Matt Tapper, Managing Director of Global Markets for Lion Beer, Cider and Wine, the Australian organization behind the Little Creatures brand, states that “the craft beer scene in China is still in [its] early stages, but there’s certainly growing interest in both on and off-premise.”

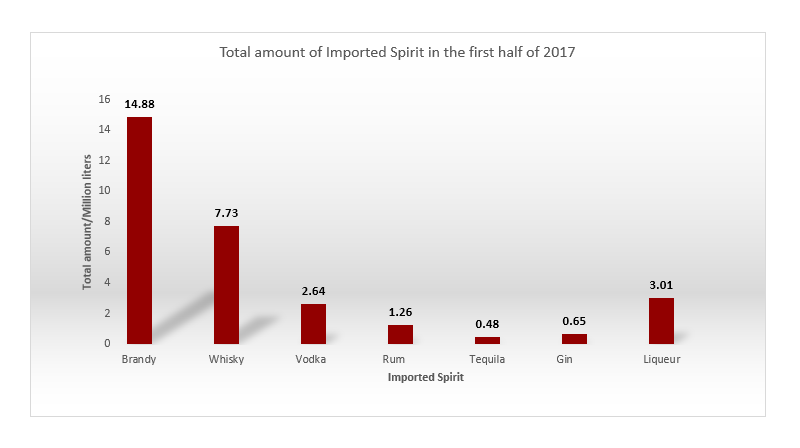

The Chinese spirits market is growing substantially. The imported spirits data collected by China Customs, shows that approximately 30.6 million liters of the seven categories of spirits were sold in the first half of 2017, an increase of 22.8% versus previous year. The quantities of each of the seven categories vary significantly. Figure 1 shows the total amount by category imported during the first half of 2017. The data shows that brandy is the favorite spirit drink in China, with 14.88 million liters imported, accounting for 48.5% of China’s spirits market. In terms of growth rate, vodka imports dramatically increased, up 108% from last year.

Meanwhile, imports of Rum and Tequila also increase 50%. This growth performance indicates that Chinese consumers’ habits are changing and expanding, from brandy to other categories of spirit beverages, especially vodka, rum and tequila. In addition, China Customs data also shows that Shanghai is the main place to trade spirit drinks, with market share accounting for more than 50% of the total Chinese market.

First-tier cities are the main marketplace for spirit drinkers, as consumers in these cities tend to enjoy a higher quality of life. Moreover, as vodka demand increased so much in 2017, it is important to understand the country of origin from which it is imported. The data shows that 22.3% of the total vodka imported into China comes from Sweden. This demonstrates that the main market position of imported vodka is still held by the Swedish brands.

Figure 1. Total amount of Imported spirits in the first half of 2017.

Retail Trends

For imported alcohol in China, the distribution channels are divided into on-premise channels such as restaurants, hotels, clubs and bars, and off-premise channels, which involve supermarkets, convenience stores and grocery shops. Moreover, an alternative channel, e-commerce, is emerging and becoming available to consumers in China. This channel brings the interaction closer between customers and suppliers. For instance, in an e-commerce platform, one consumer can directly search for one specific product through a collection of millions of products, while one product can also be offered to millions of consumers.

Import and Manufacture

When considering establishing a business to import alcohol into China, the exporters need a valid import business license, company customs, and CIQ certificates. In addition, the imported beverage must be labeled to meet China’s food labeling standards. To reduce the cost and improve competition, it may be more effective and efficient to localize alcohol manufacturing. The benefits will include saving the costs of importing, shipping, and warehousing, as well as being able to enjoy lower labor costs on average. In China, local producers dominate the current beverage market. It is often difficult to find ways to work with and cooperate with them. For the hard challenges of entering the China market, Asia perspective will provide the best advice to help establish and improve your alcohol business in China.

Read about our market entry and expansion consulting services and our experience in the consumer products sector.

The insights provided in this article are for general informational purposes only and do not constitute financial advice. We do not warrant the reliability, suitability, or correctness of the content. Readers are advised to conduct independent research and consult with a qualified financial advisor before making any investment decisions. Investing in financial markets carries risks, including the risk of loss of principal. Past performance does not guarantee future results.

The views expressed herein are those of the author(s) and do not necessarily reflect the company's official policy. We disclaim any liability for any loss or damage arising from the use of or reliance on this article or its content. ARC Group relies on reliable sources, data, and individuals for its analysis, but accuracy cannot be guaranteed. Forward-looking information is based on subjective judgments about the future and should be used cautiously. We cannot guarantee the fulfillment of forecasts and forward-looking estimates. Any investment decisions based on our information should be independently made by the investor.

Readers are encouraged to assess their financial situation, risk tolerance, and investment objectives before making any financial decisions, seeking professional advice as needed.