With the aim to attract investors and drive growth, Vietnam launched a development strategy for the renewable energy sector in 2017. The plan, including a lucrative feed-in tariff (FIT), regulated the purchasing price of energy produced from the renewable energy sector, making it a highly profitable business. However, the incentives expired on the 30th of June 2019, making the market unregulated since then.

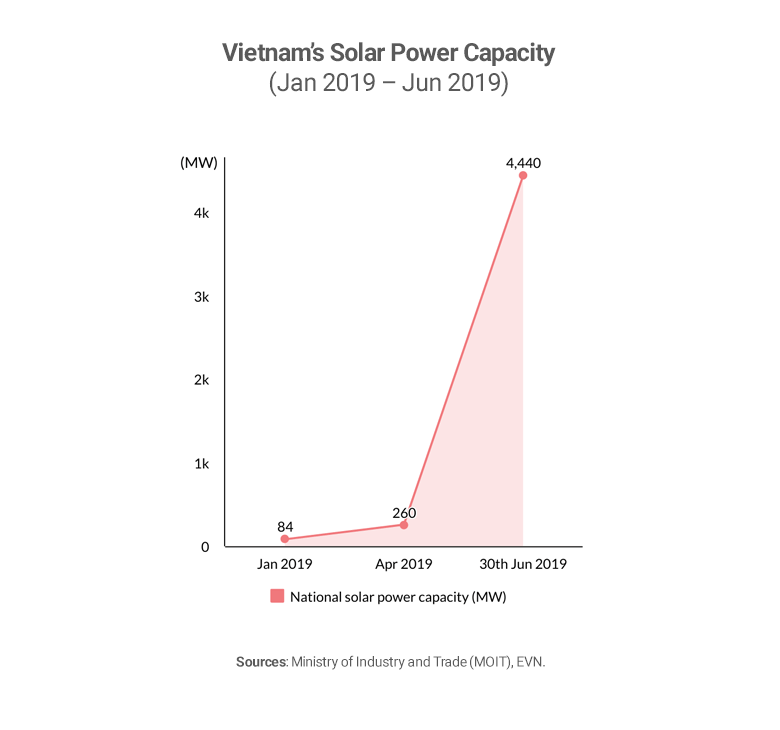

Between 2017 and 2019, the number of solar plants in Vietnam increased significantly. In 2017, non-hydro renewable plants were almost non-existent in Vietnam. Nonetheless, by the end of June 2019, 82 solar power plants with a combined capacity of 4.44 GW were connected to the national electricity grid, taking advantage of the incentives.

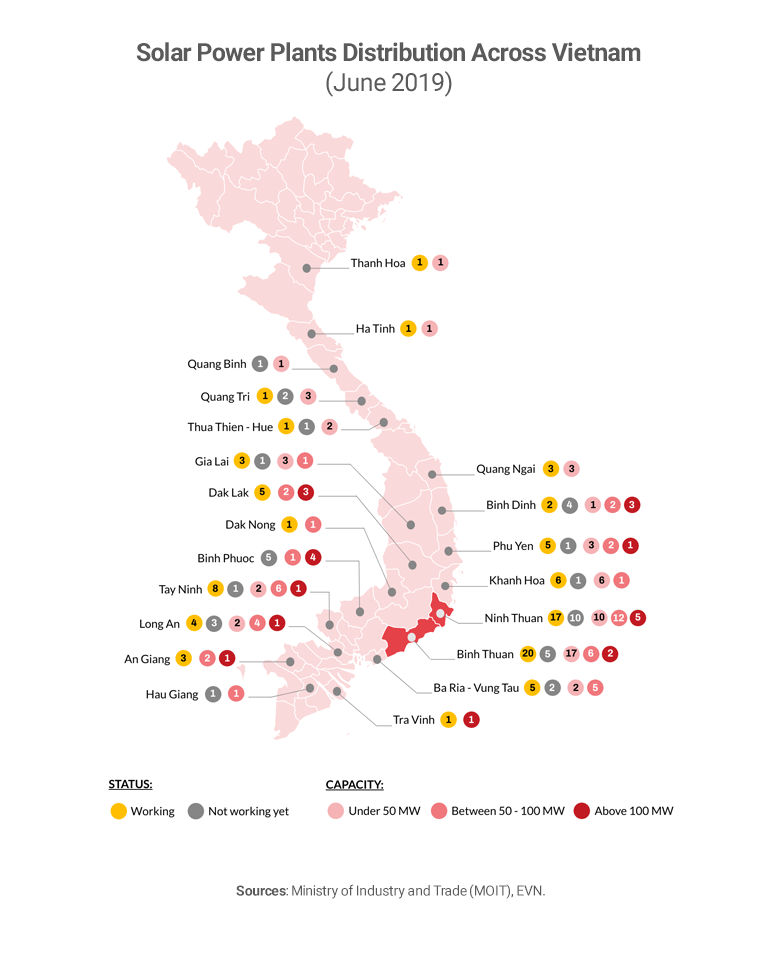

The geographical distribution of the solar power plants in Vietnam has been centered around the Central – Southern region of Vietnam, which has a typical tropical monsoon climate, featuring high heat, brief winds, high humidity and long hours of sunshine. Ninh Thuan and Binh Thuan are the two most suitable locations in Vietnam, and ss of July 2019, these two provinces had 37 active plants combined and 15 under development, accounting for about 45% of the national solar power supply.

Solar power plants that became active before the 30th of June 2019 will continue to enjoy the FIT’s for the coming 20 years. However, the purchasing price of electricity from the plants established after this date is currently unregulated until a new official decision is approved by the government.

In September 2019, the Ministry of Industry and Trade (MOIT) presented a draft decision, proposing two different options for future fixed FIT’s.

The first option for the fixed FIT introduced 12 different price levels for solar power projects. The price levels would be based on three different technology types and four different regions, due to the various hours of sunshine in different location (for example, the North of Vietnam has lower solar irradiance than the South). This proposition was not preferred, and the government was inclined to the second alternative.

The second option for a fixed FIT was similar to the first, where price levels would be based on three different technology types, but without the regional factor taken into account. This suggestion was simple and did not require incentives in specific regions with lower solar irradiance. Besides, it encourages more focus on the Southern region, where an energy shortage is expected in the future. Nevertheless, having too many plants in the same area will put heavy pressure on the regional grid which could lead to an overload. Preparation work, such as site clearance and land compensation, will also become more challenging.

In the suggested FIT, most solar power projects would have a lower purchasing price of about 30%, which may demotivate the establishment of new projects. As a result, since 30th June 2019, only seven new solar energy projects have started commercial operations in Vietnam. Relevant policie updates and adjustments to the FIT aren’t communicated effectively to the investors, causing uncertainties and challenges in managing their operations during the wait for the new decisions.

It has now been more than eight months since the previous FIT expired, and the discussion of the new official decision is still ongoing. Consequently, investors in the sector are now hesitating to set up their business in Vietnam. At Vietnam Business Forum (VBF) in January 2020, a meeting between the Government of Vietnam and industry representatives was held. Many foreign investors expressed their concerns about the FIT policy in Vietnam and urged the government to be more transparent about the changes to the FIT. Thereby the investors would be able to better manage the upcoming risks and optimize their operation accordingly.

In conclusion, solar power in Vietnam has unarguably enormous potential, with its advantages from the tropical climate. In order to fulfill future energy demands for the rapid-growing economy, especially in the manufacturing sector, Vietnam needs to enhance its national electricity transmission infrastructure and attract investors in this sector. However, after the influx of solar energy plants in the first half of 2019, the uncertain future of the sector has discouraged investors from entering Vietnam. For instance, one of the most important incentives, the FIT, is expected to be lower than before, but the final decision has not yet been made. While waiting for the new decisions, business representatives of the solar energy projects in Vietnam have requested the Vietnamese government to communicate transparently the adjustments and progress of finalizing the new FIT.

Read more about our experience in the energy and environment sector or our market entry consulting services.

The insights provided in this article are for general informational purposes only and do not constitute financial advice. We do not warrant the reliability, suitability, or correctness of the content. Readers are advised to conduct independent research and consult with a qualified financial advisor before making any investment decisions. Investing in financial markets carries risks, including the risk of loss of principal. Past performance does not guarantee future results.

The views expressed herein are those of the author(s) and do not necessarily reflect the company's official policy. We disclaim any liability for any loss or damage arising from the use of or reliance on this article or its content. ARC Group relies on reliable sources, data, and individuals for its analysis, but accuracy cannot be guaranteed. Forward-looking information is based on subjective judgments about the future and should be used cautiously. We cannot guarantee the fulfillment of forecasts and forward-looking estimates. Any investment decisions based on our information should be independently made by the investor.

Readers are encouraged to assess their financial situation, risk tolerance, and investment objectives before making any financial decisions, seeking professional advice as needed.