Relations between China and Australia have severely deteriorated in recent months as Australia joined the US in seeking a probe of China amid questions over the origin of the coronavirus.

The tension between the two nations reached its peak in the second quarter of the year when China cut beef imports from Australia’s four largest meat processors and announced hefty tariffs on Australian barley imports. Moreover, China is threatening to target more Australian exports, including wine and dairy, jeopardizing the trade relations of these two countries further.

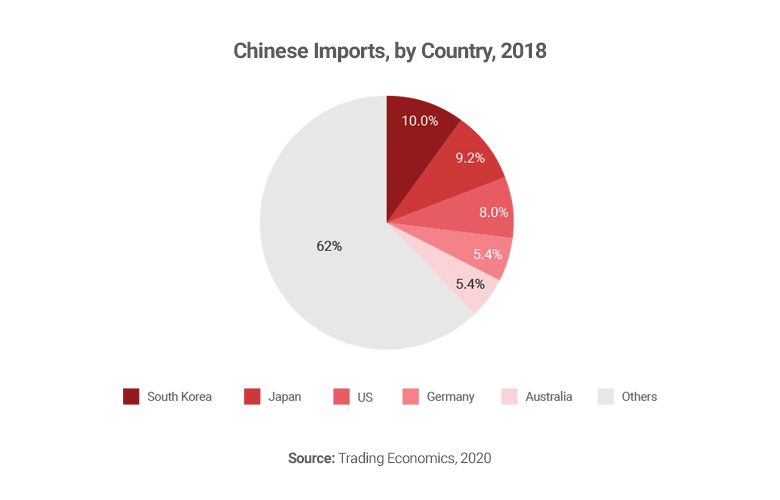

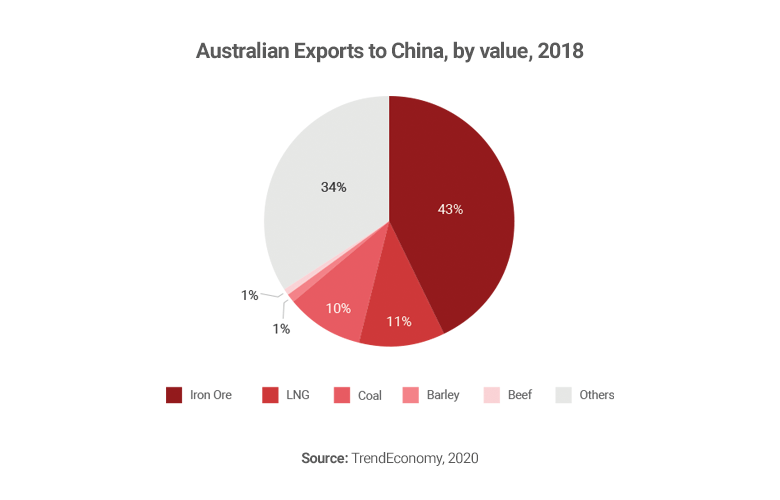

Beijing’s actions towards Australian agricultural commodities were strongly unwelcomed and landed a critical hit on Australia’s agricultural production output. However, it should be noted that the value of agricultural imports is insignificant in terms of the overall trade value between China and Australia. Australia is one of China’s five largest trade partners with a recorded export value of 105 billion USD 2018. Among which, the import value of beef and barley accounts for only 2%. The biggest export from Australia to China is natural resources, which accounts for roughly 60% of the total export value.

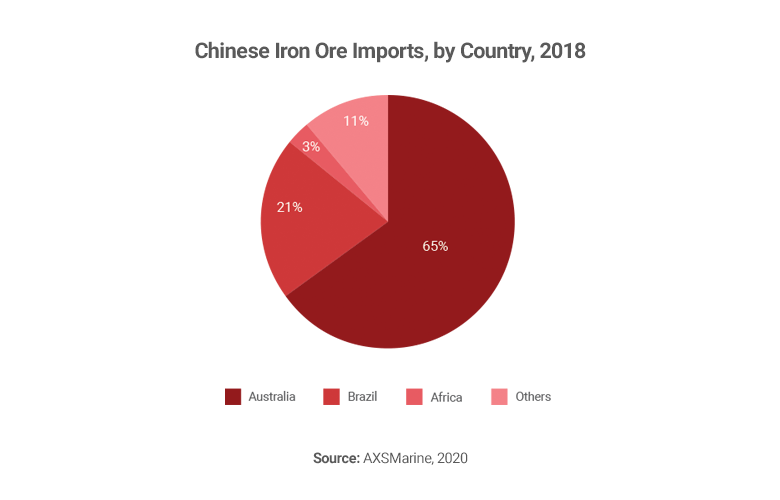

Despite rising tensions between China and Australia, China has yet to target its biggest commodity import from Australia – iron ore. This is because China does not have many sourcing alternatives for iron ore at the moment while the demand from Chinese steel mills rises to supply Beijing’s infrastructure building push, aiming to boost China’s economic recovery. Australia is currently the world’s largest iron ore producer and exporter, which also accounts for more than 60% of iron ore imports to China. Therefore, introducing restrictions on Australian iron ore would not only hurt Australian producers, but also cause severe damage to Chinese domestic steel producers as well as China’s economic development plan.

However, an executive from the China Iron and Steel Association revealed that China is considering African alternatives to Australian iron ore. Although the exploration and production of iron ore in Africa still is far behind Australia, it should be noted that Africa has similar levels of iron ore reserves to Australia. Thus, investments in African iron ore development and production could be beneficial and worthwhile to China, especially in a situation when trade disputes between China and Australia don’t show any signs of slowing down. Once such an alternative is realised, Australia’s position as a major iron ore supplier to China will be highly threatened.

Besides iron ore, two other major commodities from Australia, coal and liquefied natural gas (LNG), are also spared at the moment as demands from China are still rising. In the first four months of 2020, China’s imports of metallurgical coal were more than half of its total imports in 2019 (52 million tons) with over 80% of those coming from Australia. Similarly, LNG imports to China were reported to be up by 9% in May. Nevertheless, China is also considering other alternatives for these commodities to secure future imports in case the trade relations between China and Australia worsen.

To conclude, China has introduced limitations on beef and barley imports from Australia as a retaliation on Australia’s demand on China to find and release the originality of the coronavirus. However, China is yet to introduce any restriction on its major import commodities from Australia due to its increasing demands and limited alternatives. Nevertheless, as China ramps up to diversify its import sources, economists and industrial experts highly recommend that Australia starts to develop relations with other trading partners to reduce its dependence on China.

Read more about our other consulting services.

The insights provided in this article are for general informational purposes only and do not constitute financial advice. We do not warrant the reliability, suitability, or correctness of the content. Readers are advised to conduct independent research and consult with a qualified financial advisor before making any investment decisions. Investing in financial markets carries risks, including the risk of loss of principal. Past performance does not guarantee future results.

The views expressed herein are those of the author(s) and do not necessarily reflect the company's official policy. We disclaim any liability for any loss or damage arising from the use of or reliance on this article or its content. ARC Group relies on reliable sources, data, and individuals for its analysis, but accuracy cannot be guaranteed. Forward-looking information is based on subjective judgments about the future and should be used cautiously. We cannot guarantee the fulfillment of forecasts and forward-looking estimates. Any investment decisions based on our information should be independently made by the investor.

Readers are encouraged to assess their financial situation, risk tolerance, and investment objectives before making any financial decisions, seeking professional advice as needed.