Singapore and Malaysia were the first countries in Southeast Asia to levy value-added-tax (VAT) on digital services provided by non-residents to consumers. In May 2020, Indonesia introduced a 10% VAT on digital service providers. Following that, the Philippines and Vietnam also set plans for imposing this type of VAT in their countries, starting from 1st of January 2021.

International digital businesses have long been able to monetize their customers from any country across the globe without being physically present in those places; instead, they are often located in countries with lower tax rates and record their revenues there. Amid the COVID-19 pandemic, millions of people started to work from home and thereby increased their use of digital products, resulting in governments losing their revenue from these foreign e-services. In such context, Indonesia, Vietnam and the Philippines have taken action to secure the public revenue from taxes by introducing the taxes on e-services provided by non-residents. The change is expected to create a fair business environment for the local e-service companies to compete with the foreign counterparts as well as to support the economy as it battles the pandemic’s impact.

Indonesia, for example, applies the tax to foreign companies that have ‘significant economic presence’ in the country and in such sectors as big data, multimedia and software. Since June 2020, Netflix, Spotify, Google, and Amazon have been subject to 10% VAT, and later in August, Facebook, TikTok and Disney Plus – to name some – have been added to the list.

In Vietnam, the National Assembly has approved a new law to collect 10% VAT from cross-border e-commerce traders and digital platform-based service providers. Non-residents are now required to register with the Vietnamese tax authority to enable tax declaration and payment. The implementation was scheduled to start in July 2020, but then delayed to 1st January 2021 in order for the government to establish a mechanism and to provide detailed guidance for implementation of the law, including setting up an online system for tax registration and declaration. The Philippines also plans the same timeline for implementing the tax setup.

Despite being the later to join the taxation of foreign digital services, Thailand’s Cabinet also approved a draft bill in June to impose VAT of 7% on digital services of foreign providers, including streaming and downloading media and apps, as well as advertising on social media platforms. The measure is being accelerated to help ease the financial impact of the COVID-19 crisis. It is expected to contribute 3 billion Baht (about EUR 100 million) to the public revenue annually.

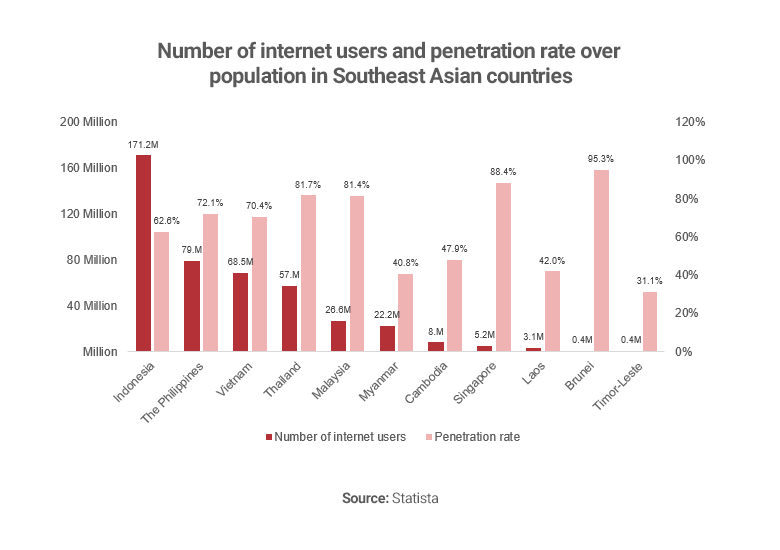

Southeast Asia is a fast-growing digital market with about 400 million internet users as of today, and a total market value of more than 100 billion USD. The internet economies of Malaysia, the Philippines, Singapore, and Thailand are growing between 20% and 30% yearly, while the growth rate in Indonesia and Vietnam is above 40%. As the region’s attractiveness to digital businesses will remain vigorous in a near future, companies which have already operated or are planning to make a move into this market should stay updated to the changes. In the latest wave of VAT imposition in Southeast Asia, companies are motivated to collect more information on their users, in order to determine if they are able to raise the prices. Companies that are dominant in a market will have a higher possibility to pursue that director. In contrast, if a business is constrained by a fixed pricing with the customers, or it is in a highly competitive market with the local service providers, it may be forced to stay at the same pricing level towards their customers.

In conclusion, countries in Southeast Asia are imposing a VAT on international providers of e-services, such as streaming platforms. The tax is supposed to help foster a sustainably business environment between domestic and international providers, while also increasing the tax revenue. Singapore, Malaysia and Indonesia have introduced it already, while Vietnam, Malaysia and The Philippines are planning to do it at the start of 2021.

Read more about our other consulting services.

The insights provided in this article are for general informational purposes only and do not constitute financial advice. We do not warrant the reliability, suitability, or correctness of the content. Readers are advised to conduct independent research and consult with a qualified financial advisor before making any investment decisions. Investing in financial markets carries risks, including the risk of loss of principal. Past performance does not guarantee future results.

The views expressed herein are those of the author(s) and do not necessarily reflect the company's official policy. We disclaim any liability for any loss or damage arising from the use of or reliance on this article or its content. ARC Group relies on reliable sources, data, and individuals for its analysis, but accuracy cannot be guaranteed. Forward-looking information is based on subjective judgments about the future and should be used cautiously. We cannot guarantee the fulfillment of forecasts and forward-looking estimates. Any investment decisions based on our information should be independently made by the investor.

Readers are encouraged to assess their financial situation, risk tolerance, and investment objectives before making any financial decisions, seeking professional advice as needed.