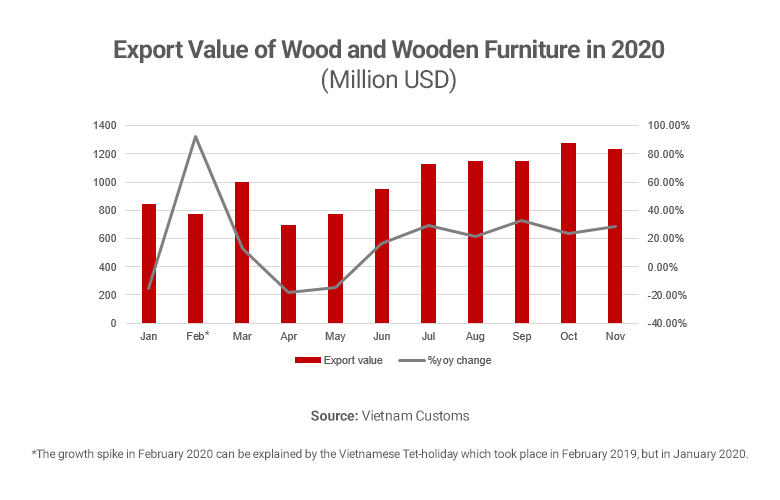

Export of wood and wooden furniture from Vietnam has increased significantly in the last two quarters of 2020. The monthly export has reached more than one billion USD every month since July, meaning that Vietnam will see a two-digit growth compared to last year, regardless of the raging pandemic.

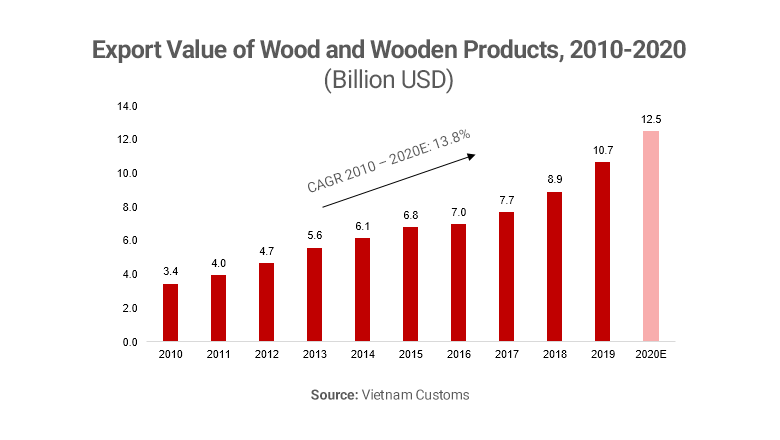

By the end of November 2020, Vietnam’s total export value of wood and wooden furniture reached 11 billion USD, of which wooden furniture accounted for 81.4%. The export value marks an increase by 15.6% compared to the same time period last year, with the total export value of 2020 to reach 12.5 billion USD, a CAGR of 13.8% between 2010 and 2020.

The outbreak of the COVID-pandemic at the start of 2020 has significantly impacted the wood industry. Key export markets such as the US, China, EU, and Japan has all suffered heavily from the pandemic. Hence, containment measures were applied, causing companies to suspend business. In Vietnam, several factories were struggling to survive due to a shortage of orders. The worst decline took place in April, with a recorded decrease of 18.5% compared to last year.

Fortunately, thanks to successful efforts to control the pandemic by Vietnam and other countries, wood and furniture factories has been able to recovere. Since June, the wood industry in Vietnam has witnessed continuous monthly year-on-year growth ranging from 16.4% to 32.9%. More surprisingly, the monthly export value reached over one billion USD for five consecutive months (July to November) for the first time in history. The US, China, Japan, and EU continue to be the largest export markets of Vietnam, comprising more than 78% of the total export value.

Besides support from the government, experts have pointed out other reasons for such impressive growth. One of them is that more people work from home to avoid the spread of the pandemic, which leads to an increase in demand for home furniture. Also, the US-China trade war caused the wood industry of China to bear anti-dumping duties and anti-subsidy taxes. This situation resulted in a shift of orders from China to Vietnam. Moreover, Vietnamese companies successfully identified and focused on strategic products that show an even higher demand than pre-COVID-19, such as wooden kitchen furniture, sofas with wooden frames, kitchen cupboards, etc.

In conclusion, wood and wooden furniture is one of the commodity groups that has bounced back with impressive export value and growth rate in the latter half of this year. The achievement has been made possible thanks to successful containment of the virus, support from the government, a global shift from China as a sourcing market, and identification of strategic products for key export markets. In the whole year 2020, the export of wood and wooden furniture is projected to reach 12.5 billion USD. However, the outlook for the industry in the future remains uncertain due to the underlying risks of new waves of COVID-19 worldwide.

Read more about our expertise in industrial goods and services or other consulting capabilities.

The insights provided in this article are for general informational purposes only and do not constitute financial advice. We do not warrant the reliability, suitability, or correctness of the content. Readers are advised to conduct independent research and consult with a qualified financial advisor before making any investment decisions. Investing in financial markets carries risks, including the risk of loss of principal. Past performance does not guarantee future results.

The views expressed herein are those of the author(s) and do not necessarily reflect the company's official policy. We disclaim any liability for any loss or damage arising from the use of or reliance on this article or its content. ARC Group relies on reliable sources, data, and individuals for its analysis, but accuracy cannot be guaranteed. Forward-looking information is based on subjective judgments about the future and should be used cautiously. We cannot guarantee the fulfillment of forecasts and forward-looking estimates. Any investment decisions based on our information should be independently made by the investor.

Readers are encouraged to assess their financial situation, risk tolerance, and investment objectives before making any financial decisions, seeking professional advice as needed.