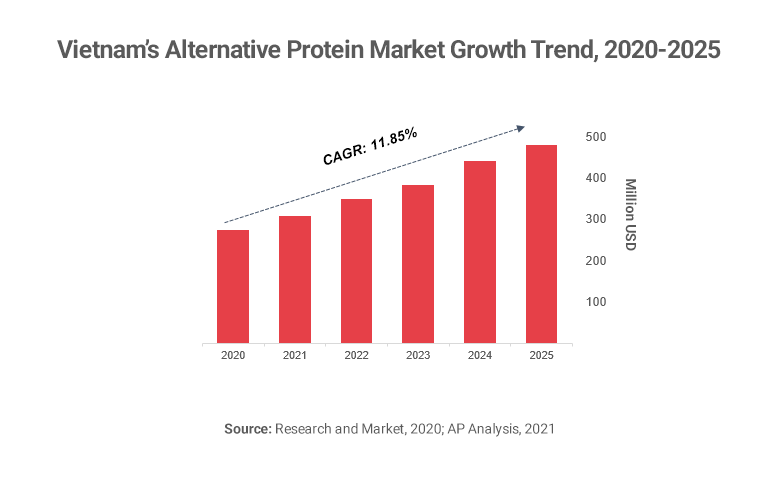

Vietnam’s Alternative Protein Market has already witnessed great growth in recent years and is predicted to grow strongly between 2021 and 2025 with a CAGR of 11.85% and reach 500 million USD by 2025. With the aggressive growth in the upcoming years, the market has become attractive for both foreign and domestic entrepreneurs, reflected by the rising foreign direct investment as well as the dynamic participation of local players ranging from start-up to leading food manufacturers.

By the end of 2020, Vietnam’s Alternative Protein Market reached 249 million USD, with the dominant share of soy-based protein (70%). Despite the raging pandemic, the market is expected to grow strongly with a CAGR of 11.85% the coming five years. The strong growth of Alternative Protein in Vietnam is mainly driven by the increasing health concerns among consumers and growing consumer focus in sustainability as well as ethical considerations.

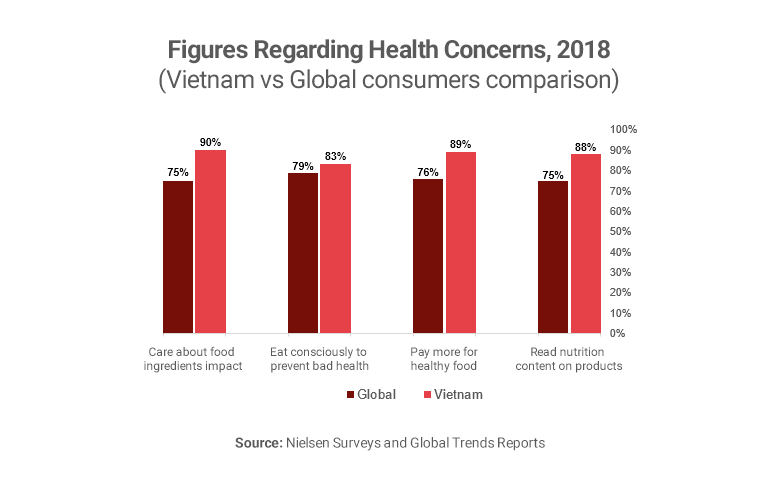

The rising demand for healthy sources of protein of Vietnamese consumers has further driven the growth of alternative protein market in Vietnam. According to Nielsen Surveys and Global Trend reports in 2018, health concern is by far the most important trend that affects alternative protein intake in Vietnam. The study showed that 37% of Vietnamese consumers consider health to be among their top two concerns while 90% are concerned about the long-term health impact of the ingredients.

Another rising concern is the environmental impact of the production of animal-based meat that have impacted the drastic growth of meat substitutes market in Vietnam. According to an analysis of The Guardian, meat production uses the vast majority of farmland (83%) and produces 60% of agriculture’s greenhouse gas emission. Therefore, alternative proteins which have less impact on environment and require less land-use, have gained popularity among Vietnamese consumers who are becoming more conscious about environmental issues. The market is also receiving increasing governmental support, reflected by the new tax incentives for entities that focus on clean, high-tech, and eco-friendly agriculture.

With more people shifting away from animal-based meat toward healthier and more sustainable protein alternatives, many food manufacturers ranging from start-up to leading food companies, and even meat producers are embracing alternative protein products to meet the increasing demand.

The market also captures the attention of foreign investors, reflected by a range of global plant-based protein brands such as Beyond Meat to enter Vietnam’s market in the recent years. In Vietnam, Cricket One – a start-up company that produces cricket protein powder received multi-million dollars investment in late 2020 from a Singaporean Investment Fund and continues to gain attention from foreign investors. The company is currently having its products sold in twelve different countries and is the only one in Asia that have the permission to export for human consumption to Europe. Also, Hadara Corporation – a Japanese plant-based meat company that already has its products present in Singapore and Thailand is also looking for distributors in Vietnam.

In conclusion, there is no doubt that Vietnam is a potential market of alternative protein for both international and domestic players from start-up to leading companies. The demand for healthier and more sustainable sources of protein of Vietnamese consumers are increasing considerably due to their rising concerns on the impact of animal-based protein on their health as well as the environment. Vietnam’s Alternative Protein Market is therefore predicted to grow strongly in the upcoming years and will continue to gain the attention of foreign investors.

Read more about our expertise in the consumer products sector or see our other consulting capabilities.

The insights provided in this article are for general informational purposes only and do not constitute financial advice. We do not warrant the reliability, suitability, or correctness of the content. Readers are advised to conduct independent research and consult with a qualified financial advisor before making any investment decisions. Investing in financial markets carries risks, including the risk of loss of principal. Past performance does not guarantee future results.

The views expressed herein are those of the author(s) and do not necessarily reflect the company's official policy. We disclaim any liability for any loss or damage arising from the use of or reliance on this article or its content. ARC Group relies on reliable sources, data, and individuals for its analysis, but accuracy cannot be guaranteed. Forward-looking information is based on subjective judgments about the future and should be used cautiously. We cannot guarantee the fulfillment of forecasts and forward-looking estimates. Any investment decisions based on our information should be independently made by the investor.

Readers are encouraged to assess their financial situation, risk tolerance, and investment objectives before making any financial decisions, seeking professional advice as needed.