Craft Beer is becoming a new trend on Vietnam’s beer market and is favoured by the majority of the young Vietnamese generation thanks to its unique flavours. Although Vietnam is still an undeveloped market for craft beer, the alcohol consumption habits of consumers and the rapid growth of the middle class in the country will continue to drive the growth of the craft beer industry in the coming years and continue to attract new players to enter the market.

The local Craft Beer market started to thrive around 2014 when foreign beer brewers started brewing in Saigon. Since then, many famous Vietnamese craft beer brands such as Platinum, Pasteur Street Brewing Company, Winking Seal, Heart of Darkness, Fuzzy Logic and C-Brewmaster have appeared and gained a proven position amongst Vietnamese consumers, especially the among the young generation. These craft beer producers do not only serve the local consumers, but have also embarked distribution internationally to America, Europe and all-around Asia.

The craft beer market of Vietnam has also witnessed a penetration from foreign cooperation’s that want to take part of this thriving market. In 2018, Golden Gate, a pioneer in the restaurant chain business model in Vietnam, officially opened its American imported craft beer chain (Craftbrew Vietnam) in Hanoi with the expectation of becoming a bridge for America’s leading craft beer manufacturers to enter Vietnam’s market and bringing the Vietnamese beer lovers opportunities to enjoy high-quality and famous American craft beer brands. As of June 2021, Golden Gate has a total of 55 restaurants across the country, serving different craft beer brands such as Kona, Lost Coast, Green Flash, Sierra Nevada and Blue Moon.

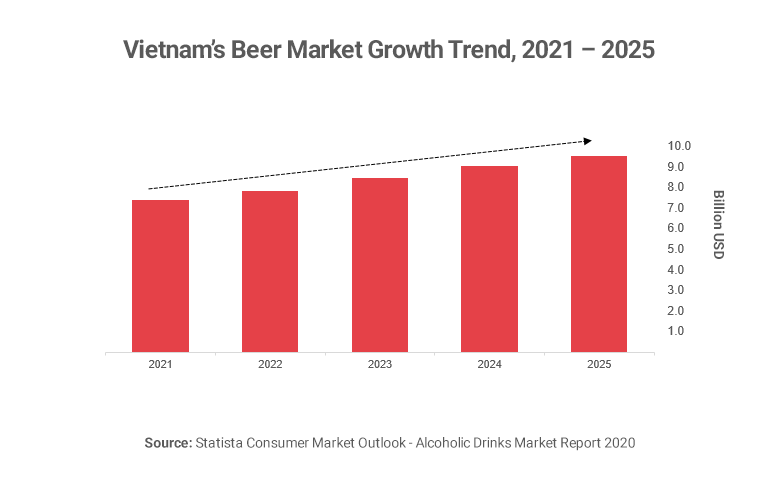

Further, the Vietnamese beer market is expected to grow at a CAGR of 6.44% between 2021 and 2025 and is expected to reach 9.5 billion USD in 2025. Additionally, the middle class in Vietnam, which is the main consumer of craft beer, is growing rapidly and is predicted to account for more than 50% of the population by 2045, according to the World Bank. Craft beer, therefore, will be a lucrative niche market for businesses.

Besides the great opportunities in Vietnam, the craft beer industry is also facing certain challenges in Vietnam. The most noticeable one is the higher price compared to the regular beers. In Vietnam, the price of a regular beer is only about 0.6 to 0.9 USD/bottle, while craft beer is ranging from 2.9 to 3.8 USD/bottle. The price differences are mainly driven by the complicated production process of Craft Beer, and its higher nutritional composition compared to other types of beer. This has posed the challenge for craft beer producer in attracting the Vietnamese price-sensitive consumers.

In conclusion, the craft beer market in Vietnam is expected to thrive in the next few years and will continue to attract the attention of both local and foreign players despite the challenges it might face. The rising income and increasing alcohol consumption as well as the changing tastes and preferences of Vietnamese consumers are opening up business opportunities for craft beer manufacturers and will continue to drive the growth of Vietnam’s craft beer industry in the upcoming years.

Read more about our expertise in the consumer products sector or see our other consulting capabilities.

The insights provided in this article are for general informational purposes only and do not constitute financial advice. We do not warrant the reliability, suitability, or correctness of the content. Readers are advised to conduct independent research and consult with a qualified financial advisor before making any investment decisions. Investing in financial markets carries risks, including the risk of loss of principal. Past performance does not guarantee future results.

The views expressed herein are those of the author(s) and do not necessarily reflect the company's official policy. We disclaim any liability for any loss or damage arising from the use of or reliance on this article or its content. ARC Group relies on reliable sources, data, and individuals for its analysis, but accuracy cannot be guaranteed. Forward-looking information is based on subjective judgments about the future and should be used cautiously. We cannot guarantee the fulfillment of forecasts and forward-looking estimates. Any investment decisions based on our information should be independently made by the investor.

Readers are encouraged to assess their financial situation, risk tolerance, and investment objectives before making any financial decisions, seeking professional advice as needed.