ODM Furniture Supplier Search in Vietnam for a Nordic e-Retailer

The client, one of the largest e-retailers of furniture and interior design in the Nordic, has been doing most of their sourcing in China for decades. However, based on the global supply chain situation, the client believed that it’s a must to diversify their sources as well as product assortments to avoid disruptions and increase their competitiveness. Vietnam is the top-of-mind location for the client as they had some experiences working with Vietnamese suppliers before and were satisfied with the outcome. Moreover, the continuously improved production capabilities and the recently ratified free trade agreement between EU and Vietnam have made the country extremely appealing to the client.

With that target being set, the client came to ARC Consulting to ask for help in expanding their sourcing activities to Vietnam. The project aimed to identify the most suitable ODM outdoor furniture manufacturers for the client and facilitate business processes between them and selected suppliers.

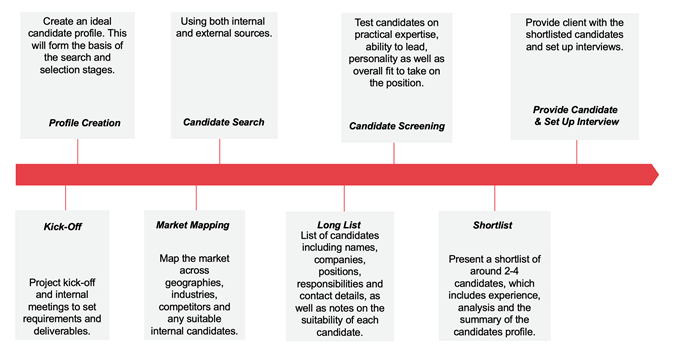

First, the client revealed types and target prices of products that they would like to source in Vietnam. Consultant team of ARC Consulting performed a supplier search on the Vietnam market accordingly.

Several suppliers were contacted and investigated to evaluate their suitability. Our consultants then visited shortlisted suppliers to further evaluate their production capabilities and product assortment. Suppliers’ product portfolios and quotations were also collected and brought into discussion with the client to make sure that the selected suppliers matched their expectations. Along the way, ARC Consulting team also looked out for potential assortments to recommend to the client.

Based on collected information and data, shortlisted suppliers were assessed and benchmarked against each other to identify the most suitable suppliers for the client to work with.

After the client decided to work with recommended suppliers, ARC Consulting helped them to proceed with other steps toward the official order placement including sample order placement, sample testing, and contract negotiation. ARC Consulting also made sure that the European standards for furniture as well as the client’s standards (style, color, packaging, etc.) were strictly followed during sample production.

Finally, based on expected order quantities and previously discussed quotations, ARC Consulting helped the client to negotiate contract terms and prices to reach their target before placing the official orders.

Throughout the project, over 100 suppliers were screened, 50 suppliers were contacted and evaluated, 9 suppliers were selected for site visit and in-depth evaluation, and finally 4 suppliers were shortlisted and recommended to the client.

ARC Consulting provided the client with a comprehensive report of suppliers, so they have a better understanding of leading manufacturers as well as an overview of the industry landscape in Vietnam.

100% of the samples passed the product test performed by an authorized lab before the official order is placed.

ARC Consulting successfully facilitated the contract signing and official order placement between the client and four Vietnamese suppliers.

See more about our sourcing & supply chain management and our retail expertise.